Menu

Principal Office, Houston Texas Remote Services, Texas and Florida

(by appointment only)

713.568.8600

(by appointment only)

713.568.8600 | 904.425.9046

Comprehensive estate planning involves more than just planning for your legacy after your death, avoiding probate, and reducing taxes. Good estate planning also addresses incapacity and appoints people to make legal, financial, and medical decisions for you if you are alive but unable to make those decisions for yourself (in other words, if you are incapacitated).

Without a comprehensive plan for your incapacity, your family will have to go to court to have a judge appoint a guardian to make healthcare decisions for you and manage your money and property. A guardian will make all personal and medical decisions on your behalf as part of a court-supervised guardianship. A guardian will also make all financial and legal decisions on your behalf as part of a court-supervised guardianship. These roles may be filled by the same person or by two different people, depending on the circumstances. Keep in mind that the court may not appoint the person or people for these roles that you would have chosen. Until you regain capacity or pass away, you and your loved ones will have to endure expensive, public, and time-consuming court proceedings, which may include filing annual reports and obtaining prior judicial approval for certain actions.

Overall, there are two aspects of incapacity planning that must be considered: financial and healthcare.

Overall, there are two aspects of incapacity planning that must be considered: financial and healthcare.

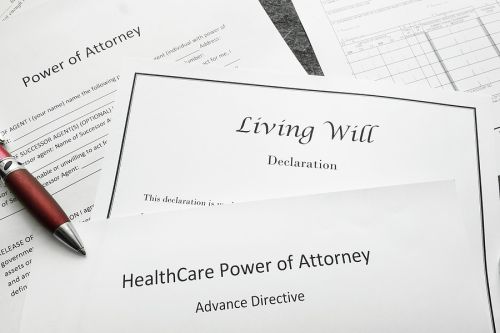

To avoid these problems, you should have these five essential legal documents in place before becoming incapacitated so that your loved ones are empowered to make decisions for you:

Financial power of attorney. A financial power of attorney is a legal document that gives your trusted decision-maker (the agent) the authority to pay bills, make financial decisions, manage investments, file tax returns, mortgage and sell real estate, and address other financial matters for you that are described in the document. Financial powers of attorney come in two forms: immediate and springing. An immediate durable power of attorney allows your agent to act for you as soon as you sign the document. A springing power of attorney, on the other hand, is legally valid when you sign it, but your agent can only act for you after you have been determined to be mentally incapacitated. It is important to note that some states, such as Florida, do not recognize springing financial powers of attorney. And McCreary Law Office does not recommend springing powers of attorney.

Financial power of attorney. A financial power of attorney is a legal document that gives your trusted decision-maker (the agent) the authority to pay bills, make financial decisions, manage investments, file tax returns, mortgage and sell real estate, and address other financial matters for you that are described in the document. Financial powers of attorney come in two forms: immediate and springing. An immediate durable power of attorney allows your agent to act for you as soon as you sign the document. A springing power of attorney, on the other hand, is legally valid when you sign it, but your agent can only act for you after you have been determined to be mentally incapacitated. It is important to note that some states, such as Florida, do not recognize springing financial powers of attorney. And McCreary Law Office does not recommend springing powers of attorney. Advanced directive or living will. An advance directive or living will shares your wishes regarding end-of-life care if you become incapacitated. Although a living will is not necessarily enforceable in all states, it can provide meaningful information about your desires—even if it is not strictly enforceable.

Advanced directive or living will. An advance directive or living will shares your wishes regarding end-of-life care if you become incapacitated. Although a living will is not necessarily enforceable in all states, it can provide meaningful information about your desires—even if it is not strictly enforceable.Once you create all of these legal documents for your incapacity plan, you cannot simply stick them in a drawer and forget about them. Instead, you must update and review your incapacity plan periodically and when major life events occur, such as moving to a new state or getting divorced. If you keep your incapacity plan up-to-date and make the documents available to your loved ones and trusted helpers, it should work the way you expect it to if needed. If you need to create or update your incapacity plan, please give us a call.

© 2026 McCreary Law Office, PLLC